Table of Contents

From Crypto-Curious to Crypto-Ready: A CTO's Guide to Implementing Bitcoin Payment APIs

Comet Cash Team

•

Dec 10, 2025

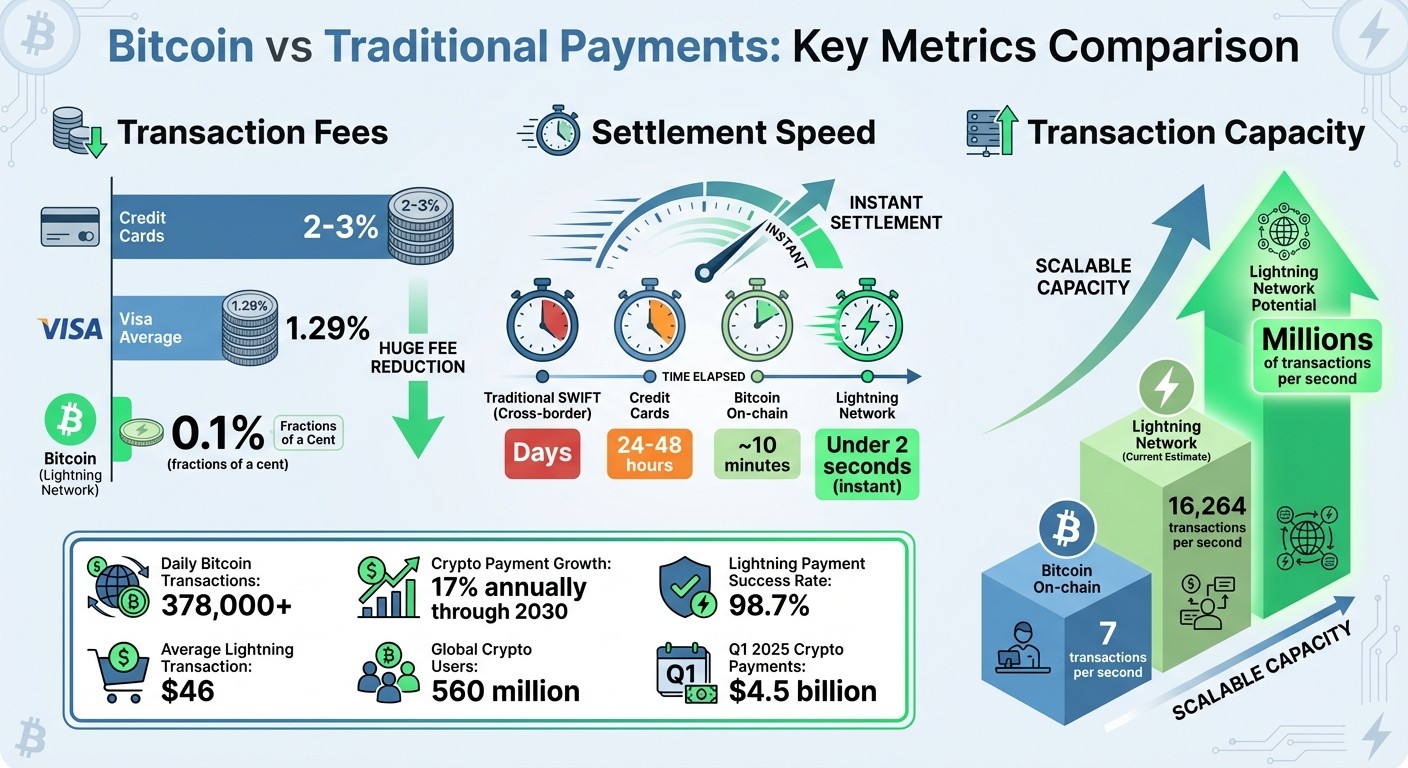

Bitcoin payments are no longer a niche concept - they're becoming a practical solution for businesses. With lower fees, faster settlements, and global reach, Bitcoin and the Lightning Network offer a real alternative to traditional payment methods like credit cards and ACH transfers. Here's the gist:

Why Bitcoin Payments Matter: Save on fees (as low as 1% vs. 2-3% for cards), settle transactions in under 2 seconds (via the Lightning Network), and simplify cross-border payments without SWIFT delays.

Adoption Is Growing: Over 378,000 Bitcoin transactions happen daily, and cryptocurrency payments are projected to grow 17% annually through 2030.

Lightning Network Benefits: Instant payments, microtransaction support, and minimal fees make it ideal for businesses handling high transaction volumes.

This guide covers everything you need to know about integrating Bitcoin payment APIs - technical setup, compliance, and operational considerations - to build a secure, efficient payment system. Whether you're starting small or scaling up, Bitcoin payments can streamline your processes and open doors to a global customer base.

Bitcoin vs Traditional Payments: Speed, Fees, and Transaction Capacity Comparison

Understanding Bitcoin and the Lightning Network

Bitcoin as a Settlement Layer

Bitcoin, initially designed as peer-to-peer electronic cash, now serves as a secure, decentralized settlement layer for transactions. It operates through a network of computers that use mining to achieve consensus, ensuring the integrity of a public and transparent ledger.

As the "layer 1" blockchain, Bitcoin provides the foundation for all transactions, including those processed by "layer 2" solutions like the Lightning Network. On-chain Bitcoin transactions require full verification, which takes about 10 minutes per block. However, this process has limitations: the network can only handle around 7 transactions per second, and during busy periods, transaction fees can exceed $15.00.

This creates a trade-off. On-chain transactions offer high security but are slower and more expensive. On the other hand, faster custodial solutions rely on delegated trust. Businesses must carefully evaluate these options based on their transaction needs, balancing speed, cost, and security.

Lightning Network Basics for Scalability

The Lightning Network, a Layer 2 protocol built atop Bitcoin, was developed to address Bitcoin's challenges with scalability, transaction fees, and processing times. It enables instant, low-cost transactions by establishing off-chain payment channels between users, reducing congestion on the main Bitcoin blockchain.

Only the opening and closing of these channels are recorded on the Bitcoin blockchain, allowing an unlimited number of transactions to occur off-chain within the channel. To maintain security, the network uses multi-signature wallets, commitment transactions, and HTLCs (Hashed Timelock Contracts). Payments can even route through intermediate nodes to connect users without a direct channel. On average, a Lightning payment passes through three channels.

The scalability of the Lightning Network is impressive - it can handle thousands or even millions of transactions per second. Current estimates suggest it supports up to 16,264 transactions per second. Transaction fees are minimal, often just fractions of a cent, with an average fee of 0.1%, significantly lower than Visa's average fee of 1.29%. River Financial reports a 98.7% success rate for Lightning payments with an average transaction size of $46, a substantial improvement from 2018, when $5 transactions failed nearly half the time.

While Lightning's speed and low costs are game-changers, businesses must also navigate the complexities of compliance and accounting.

Regulatory and Accounting Considerations

For U.S. businesses adopting Bitcoin and Lightning Network payments, managing tax and accounting requirements can be challenging, especially with off-chain transactions. The repeal of Staff Accounting Bulletin (SAB) 121 by SAB 122 has created new opportunities for banking institutions to engage with digital assets. As Aaron Jacob, VP of Accounting at Taxbit, explains:

"SAB 122 completely nullifies SAB 121, and that has opened the door for banking institutions to re-enter the digital asset space".

Compliance involves adhering to standards for digital asset accounting (GAAP, IFRS, tax), money transmitter licensing, KYC/KYB, AML, and transaction monitoring. Lightning transactions add complexity because of their off-chain nature. Jacob highlights this challenge:

"Lightning allows you to reduce fees and increase speed. But institutions still need channel-level visibility for accounting and compliance".

In April 2025, Voltage and Taxbit announced an integration to provide enterprise-grade compliance for Bitcoin and stablecoin transactions on the Lightning Network. This integration ensures off-chain Lightning transactions are accurately tracked and reported, meeting GAAP, IFRS, and tax standards. One enterprise client using Taxbit's solution achieved a 75% reduction in accounting overhead.

To fully benefit from Lightning's speed and cost efficiency, businesses must partner with regulated entities or adopt automated tracking solutions to stay compliant while building a reliable payment infrastructure.

Designing a Bitcoin Payment Architecture

Core Components of a Bitcoin Payment System

A Bitcoin payment system depends on several key components working together to process transactions securely and efficiently. At its heart, a payment gateway serves as the bridge between your platform and the blockchain, connecting wallets through QR codes or direct links. Some gateways even support card-to-crypto conversions, letting customers pay with traditional methods while you receive Bitcoin.

Another crucial element is dynamic invoice generation, which creates a unique payment request for every transaction. For secure storage, non-custodial solutions using HD wallets ensure you maintain control over digital assets. To address exchange rate fluctuations, real-time fiat-to-BTC conversion is invaluable. Additionally, webhook and event handling ensures your system stays updated as payments move through various stages.

One standout feature to consider is the Lightning Network. Unlike standard on-chain transactions, which can take about 10 minutes to settle, the Lightning Network enables near-instant payments with minimal fees, making it ideal for faster and more cost-effective transactions.

Integrating Bitcoin Payments with Existing Systems

Once you've identified the essential components, the next step is integrating Bitcoin payments into your platform seamlessly.

The approach you choose depends on your technical setup and infrastructure. A simple option is using hosted checkout pages. For e-commerce platforms, pre-built plugins can connect directly to your shopping cart system, while custom integrations can leverage APIs and webhooks to align with your specific business logic.

On the customer side, integration often involves adding payment buttons, QR codes, or wallet connection options to your checkout process. Behind the scenes, a payment orchestration system manages transactions, tracks state changes, and addresses edge cases like partial payments or expired invoices. To maintain a smooth experience, monitor transaction success rates and system health, ensuring any issues are flagged before they impact your customers. By treating Bitcoin payments as part of your existing infrastructure - rather than a standalone system - you can simplify operations and reduce long-term maintenance challenges.

Using Comet Cash for Bitcoin Payment Infrastructure

For a streamlined implementation, consider using an all-in-one solution like Comet Cash.

Comet Cash provides non-custodial Bitcoin and Lightning payment tools through real-time APIs, SDKs, and dashboards. It simplifies complex tasks like node management, liquidity, and network connectivity, while giving you full programmatic control over your Bitcoin payment setup.

One standout feature is its team-based node control, which allows multiple developers and operations staff to manage permissions and configurations, similar to how cloud infrastructure is handled. You can customize channel settings and node configurations to suit your transaction needs and risk preferences. The platform also includes integrated fiat-to-crypto conversion tools that connect to pricing feeds, automating USD-to-BTC rate calculations.

For CTOs deciding between building in-house or outsourcing, Comet Cash significantly reduces the need for specialized expertise. Its SDK and CLI tools integrate smoothly into existing development workflows, while its user-friendly dashboard provides non-technical team members with clear visibility into payment operations and system health.

Step-by-Step Guide to Implementing Bitcoin Payment APIs

Preparing Your Environment

Before diving into coding, start by setting up a sandbox environment to test your integration without using real funds. Most Bitcoin payment providers offer these testing spaces, allowing you to simulate transactions safely. Experts stress the importance of using sandbox environments and securely managing secrets to ensure a safe integration process.

Next, secure your API credentials. When you register with a payment provider, you’ll receive a unique pair of API keys (commonly a KEY and SECRET) to authenticate your server’s requests. Protect these credentials by storing them in environment variables or a dedicated secrets manager. Enable two-factor authentication (2FA) and, if possible, restrict access using IP whitelisting.

Make sure your infrastructure is ready to handle outbound API calls and receive incoming webhooks for real-time updates on transactions. Familiarize yourself with the API documentation and take advantage of available support channels like Slack communities, forums, or live chat - many providers offer these resources to assist developers.

Once your environment is set up and communication with the API is verified, you can move on to designing your payment flows.

Designing Payment Flows

Start by creating payment intents in USD. When a customer initiates a purchase, use the API to specify the USD amount. The payment provider will return the equivalent Bitcoin or Lightning Network amount, along with the current conversion rate. This method allows you to manage transactions in familiar fiat terms while accepting cryptocurrency.

Next, generate a unique invoice. For smaller, instant payments, use the Lightning Network. For larger transactions that require higher security, opt for on-chain payments.

To protect against price fluctuations, lock the exchange rate at the time the invoice is created. This ensures both you and your customer are shielded from volatility during the payment window.

Backend and Frontend Integration

With your payment flows defined, it’s time to integrate them into your backend and frontend systems.

On the backend, configure webhooks to receive real-time notifications about payment statuses. When a payment is confirmed, your webhook endpoint should update the order status, initiate fulfillment processes, and securely store transaction details - such as the USD amount, conversion rate, and Bitcoin amount - in your database. This data is essential for accounting and audit purposes.

For the frontend, display payment amounts in both BTC and USD to avoid any confusion. Generate a QR code containing the payment request so customers can easily scan it with their mobile wallets. Provide clear status updates throughout the payment process, such as "Awaiting payment", "Payment detected", "Confirming", and "Confirmed". Lightning payments are nearly instant, but for on-chain transactions, include an estimated confirmation time based on network activity.

Finally, test your integration thoroughly on the testnet. Walk through the entire payment flow to identify and resolve any potential user experience issues.

Security, Scalability, and Operations Best Practices

Security Best Practices

When setting up a Bitcoin payment system, robust security measures are non-negotiable. Start by implementing multiple layers of protection. Use OAuth 2.0 with multi-factor authentication (MFA) and certificate-based mutual TLS for API access. Keep access tokens short-lived, limit their scope, and rotate them frequently to minimize risks.

Adopt role-based access control (RBAC) to restrict team members' access to only the data and functions they need. Always store API credentials securely - use environment variables or a secrets manager - and avoid hardcoding them under any circumstances.

Sensitive data, whether at rest or in transit, should be encrypted using strong methods like AES-256 and TLS 1.3. For Bitcoin private keys, leverage Hardware Security Modules (HSMs) for cold storage. You can also consider Multi-Party Computation (MPC) to divide key management responsibilities, reducing the risk of a single point of failure.

To stay ahead of potential threats, continuously monitor and log API transactions. Anomaly detection systems powered by AI can help identify unusual activity. For instance, 94% of financial services companies have reported API security incidents, with an average of 47 attacks per month. Implement safeguards like rate limiting and bot detection to protect against DDoS and brute-force attacks.

Scaling and Performance Optimization

Bitcoin's base layer processes just 7 transactions per second, which makes scalability a key concern. The Lightning Network, however, can handle millions of transactions per second by leveraging off-chain payment channels, making it essential for high-volume operations.

Design your system with horizontal scaling in mind. Use load balancers to distribute traffic efficiently across servers and implement caching to speed up access to frequently used data. For smoother operations, adopt asynchronous processing and queuing mechanisms to handle payment confirmations without slowing down your main application flow.

Regular load testing is critical. Test both Lightning and on-chain payment workflows during peak conditions to identify bottlenecks. Monitor key metrics like response times, memory usage, and database performance to ensure your system is ready to scale as demand grows. Once scalability is addressed, prioritize building fault tolerance and ensuring rapid recovery.

Reliability and Disaster Recovery

Reliability starts with redundancy. Deploy your infrastructure across multiple availability zones and configure automatic failover systems. For failed API calls, use retry logic with exponential backoff, and incorporate circuit breakers to prevent cascading failures.

Real-time monitoring is crucial for spotting issues like payment processing delays, webhook failures, or API errors. Set up alerts to act quickly when things go wrong. Document your incident response procedures and conduct regular drills with your team to ensure preparedness. Keep detailed transaction logs - breaches, on average, take 178 days to detect.

For enhanced scalability and reliability, consider integrating trusted solutions like Comet Cash. Its non-custodial infrastructure, team-based node control, and customizable channel settings provide enterprise-grade support. Features like real-time monitoring and encrypted infrastructure ensure uptime while meeting U.S. fintech compliance standards. Lastly, review your API provider's service level agreements to confirm they meet your availability and support requirements.

🟧 How To Accept Bitcoin & Lightning Network Payments

Conclusion: Building a Bitcoin Payment System That Lasts

Creating a Bitcoin payment system that stands the test of time requires a strong focus on three key pillars: security, scalability, and reliability.

Let’s revisit security. Protecting your system starts with secure API key management - use fine-grained permissions and encrypted vaults. Add two-factor authentication for all accounts and keep detailed logs of every API call to ensure compliance. With $4.5 billion in crypto payments processed in Q1 2025 and 40% of individuals aged 18 to 35 planning to use crypto for payments this year, the systems you build today must handle tomorrow’s demands.

For scalability, adopt technology that can manage growing transaction volumes. The Lightning Network, for example, enables faster payment processing. Ensure your system is prepared for peak demand by optimizing performance and staying current with emerging features and security updates. Regulations and technology evolve quickly, so your infrastructure must keep pace.

Reliability is equally critical. Build redundancy into your system, monitor activity continuously, and have solid backup plans in place. Use error-handling strategies like retry logic and detailed logging to detect and resolve issues early.

Comet Cash provides a great example of how to streamline Bitcoin payment infrastructure. With real-time, non-custodial tools, team-based node control, and customizable channel settings tailored for U.S. fintechs, it prioritizes security and uptime while maintaining compliance. This allows CTOs to focus less on managing infrastructure and more on delivering customer value.

As the number of crypto users grows to 560 million worldwide and transaction fees drop by 50–90% compared to traditional methods, the opportunity is clear. By building with a secure foundation, scalable technologies, and reliable partnerships, your Bitcoin payment system will be ready to meet the future head-on.

FAQs

What makes the Lightning Network a game-changer for Bitcoin payment scalability?

The Lightning Network transforms how Bitcoin handles payments by introducing off-chain transactions that are both faster and cheaper than traditional on-chain methods. By moving transactions off the main Bitcoin blockchain, it alleviates network congestion and supports a much greater volume of payments happening at the same time.

This system doesn’t just cut down on transaction fees - it also boosts overall efficiency, making Bitcoin more practical for everyday use and frequent transactions. For businesses managing large-scale Bitcoin payments, it offers a streamlined and effective solution.

What are the essential security practices for integrating Bitcoin payment systems?

When setting up Bitcoin payment systems, ensuring robust security measures is non-negotiable. Start by employing strong API authentication methods, such as API keys or OAuth, to safeguard access. Encrypt all data during transmission to protect sensitive information, and make it a habit to update your systems with the latest security patches to close any vulnerabilities.

It's also wise to enable multi-factor authentication (MFA) for user accounts, adding an extra layer of protection. Keep an eye on transactions to detect any unusual activity and adhere to established industry standards like PCI DSS. By following these practices, you can build a secure and dependable payment system that meets the demands of today's fintech landscape.

What steps can businesses take to stay compliant when accepting Bitcoin payments?

To ensure compliance when accepting Bitcoin payments, businesses need to establish strong AML (Anti-Money Laundering) and KYC (Know Your Customer) procedures. This involves verifying the identities of customers and keeping an eye on transactions to detect any unusual or suspicious activity.

It's also crucial to use a payment solution that meets both local and international regulatory standards, such as those outlined by U.S. financial authorities. Working with regulated Bitcoin payment providers that include features like transaction monitoring and automated reporting can make this process easier and help minimize potential risks.