Table of Contents

How payment APIs Can Improve your SAAS product

Comet Cash Team

•

Dec 15, 2025

Payment APIs simplify how SaaS platforms manage transactions. They handle subscriptions, upgrades, and renewals without redirecting users to third-party pages. Tools like Comet Cash integrate Bitcoin, Lightning Network, and stablecoins, enabling faster, secure, and cost-efficient payments. Key benefits include:

Instant Transactions: Real-time Bitcoin payments via the Lightning Network.

Lower Costs: Reduces fees for international payments by bypassing intermediaries.

Security: Non-custodial infrastructure ensures control over assets and compliance.

Scalability: Flexible API plans for startups to enterprise-level SaaS businesses.

With the SaaS market growing rapidly, integrating payment APIs can improve revenue by up to 10%, reduce payment failures, and support global expansion. Comet Cash offers a modern solution for seamless cross-border payments and subscription management.

How Software Companies Monetize Payments - SAAS / ISV Integration

Benefits of Using Comet Cash Payment APIs in SaaS

Comet Cash takes the concept of payment APIs to the next level, offering a range of benefits that can make a real difference for SaaS platforms. By integrating Comet Cash, you gain access to a system that combines real-time processing, cost-saving features, and a secure, non-custodial infrastructure - all designed to grow alongside your business while keeping expenses manageable.

Real-Time Payment Integration

Comet Cash enables instant Bitcoin and Lightning Network payments, completing transactions within seconds. This speed ensures that services are activated and premium features are unlocked immediately, enhancing the user experience. Thanks to the Lightning Network's ability to handle high transaction volumes, this solution is ideal for SaaS platforms catering to customers across different time zones.

Lower Costs for Cross-Border Transactions

One standout feature of Comet Cash is its ability to reduce costs for international payments. By cutting out intermediaries and avoiding currency conversion fees, the platform directly connects to Bitcoin and Lightning infrastructure. Research indicates that automating payment workflows with APIs can cut operational costs by up to 13.5%. Additionally, Comet Cash uses intelligent routing and local payment rails to offer more affordable and transparent foreign exchange options. These savings are paired with strong security measures, making it both cost-effective and reliable.

Secure Non-Custodial Infrastructure

Comet Cash’s non-custodial design ensures that you maintain control over your assets while benefiting from enterprise-grade encryption. This is especially valuable for SaaS platforms managing recurring payments and subscription billing, as it reduces risks and supports consistent revenue streams. Features like team-based node control and customizable security settings allow you to tailor the platform to meet compliance standards without sacrificing transaction speed or reliability.

Comet Cash Payment API Features for SaaS

Comet Cash brings a range of features tailored to tackle the payment challenges SaaS companies often face. With lightning-fast Bitcoin transactions and infrastructure built to scale, it provides the tools needed for subscription-based businesses to grow. These features strengthen the foundation of your SaaS payment operations, ensuring efficiency and reliability.

Bitcoin Payments and Lightning Network Integration

Comet Cash uses the Lightning Network to process Bitcoin transactions in just 2 seconds, making instant upgrades and feature unlocks a reality. By operating as a Layer 2 solution, transactions are handled off-chain, which increases speed and avoids congestion on the main Bitcoin blockchain. This method maintains the security of the Bitcoin network while delivering the performance needed for SaaS platforms managing high transaction volumes. With this setup, millions of transactions can be processed efficiently, meeting the needs of users across time zones.

And it doesn’t stop at Bitcoin - Comet Cash adds even more versatility to its payment options.

Stablecoin and Tokenized Asset Support

Beyond Bitcoin, Comet Cash supports stablecoin issuance and tokenized asset management. This allows SaaS companies to accept a broader range of digital currencies, giving their customers more payment options and making their payment systems more adaptable to different needs.

To accommodate businesses of all sizes, Comet Cash offers flexible API plans.

Scalable API Plans

Comet Cash provides three API plans - Basic, Pro, and Enterprise - designed to grow alongside your SaaS business.

The Basic plan is perfect for startups, offering real-time Bitcoin payments and core API functionality to help you get started with cryptocurrency integration.

The Pro plan adds more advanced features like stablecoin issuance, tokenized asset support, and team-based node control, along with SDK and CLI access, making it ideal for businesses that need more customization.

The Enterprise plan is built for large-scale operations, offering fully customizable infrastructure and priority support to handle high transaction volumes and complex payment needs.

This tiered structure ensures that as your SaaS business grows, your payment system can grow with it, adapting to higher transaction demands without missing a beat.

How to Integrate Comet Cash Payment APIs into Your SaaS

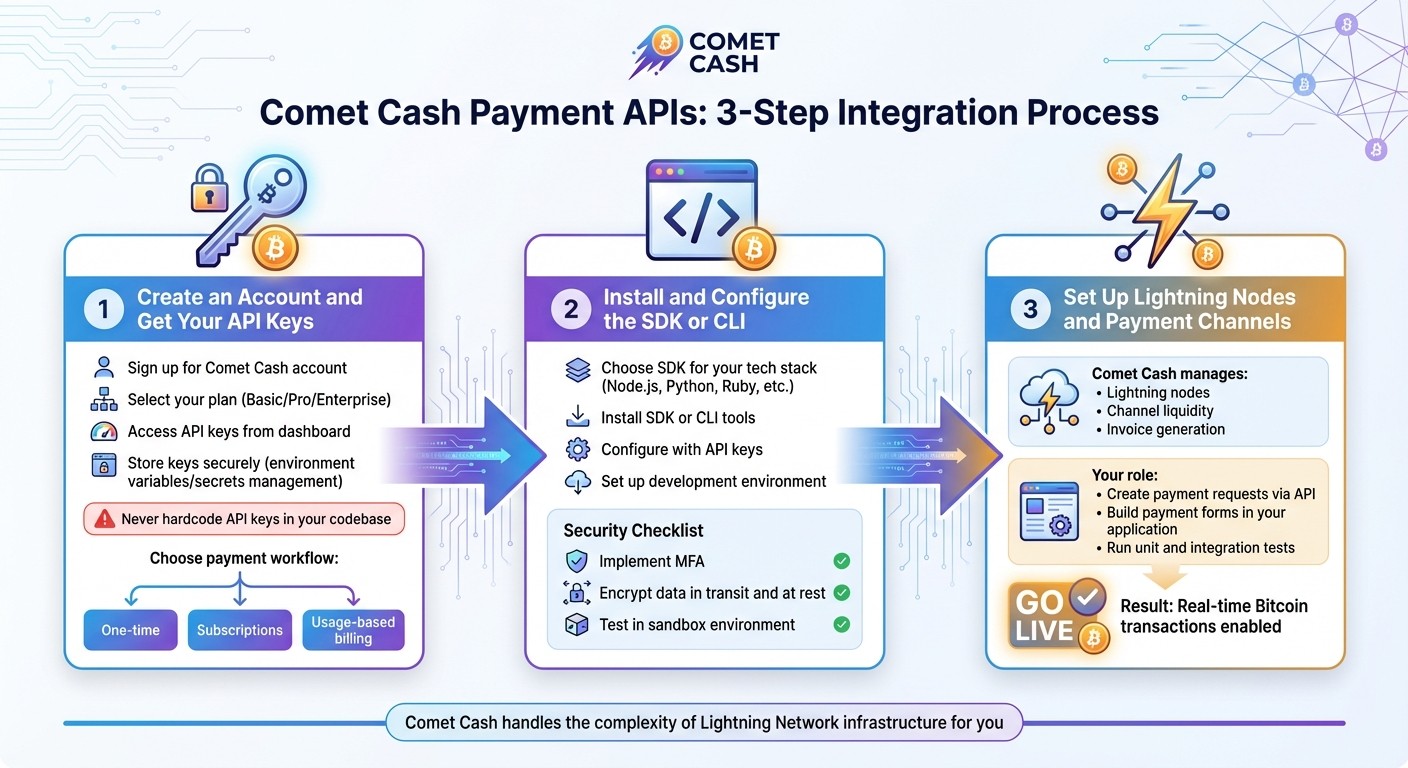

3-Step Guide to Integrating Comet Cash Payment API into Your SaaS Platform

Adding Comet Cash to your SaaS platform is straightforward, as it handles the complexities of the Lightning Network for you. Here’s a step-by-step guide to get your payment integration up and running.

Step 1: Create an Account and Get Your API Keys

Start by signing up for a Comet Cash account and selecting the plan that fits your needs. Once your account is set up, head to your dashboard to access your API keys. These keys are essential - they allow your application to securely communicate with Comet Cash's system. Make sure to store them securely, such as in environment variables or a secrets management tool. Avoid hardcoding them directly into your codebase.

Before diving in, decide on your payment workflows. Are you handling one-time payments, subscriptions, or usage-based billing? Your choice will guide how you configure the API.

Step 2: Install and Configure the SDK or CLI

To make integration easier, Comet Cash provides SDKs and CLI tools that simplify API communication. Choose the SDK or CLI that works best with your tech stack - whether it’s Node.js, Python, Ruby, or another language. Once installed, configure it with your API keys and set up your development environment for testing.

Security is critical, so implement measures like multi-factor authentication (MFA) and ensure data is encrypted both in transit and at rest. Before you go live, test everything in a sandbox environment to ensure smooth operation.

Step 3: Set Up Lightning Nodes and Payment Channels

One of Comet Cash's strengths is that it takes care of the heavy lifting when it comes to managing Lightning nodes, channel liquidity, and invoice generation. Your role is to use the API to create payment requests, while Comet Cash handles the backend processing to enable real-time Bitcoin transactions.

Focus on building and integrating payment forms into your application. Run thorough tests, including unit and integration tests, to ensure everything works as expected before launching your integration.

Measuring the Impact of Comet Cash on Your SaaS

Once you've integrated Comet Cash, it's important to keep an eye on the numbers to measure its impact. With the SaaS industry valued at $420 billion USD, tracking the right metrics will help you evaluate payment performance and its effect on your customers.

Track Revenue Growth and Customer Retention

Keep a close watch on your Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) to understand how the integration is affecting your bottom line. Pay special attention to Net Revenue Retention (NRR) - a number above 100% means you're growing revenue from existing customers, even if no new ones are added. For context, SaaS businesses typically see retention rates between 80% and 90%. Engaged customers can boost profitability by more than 23%.

It's also worth monitoring user payment activity to identify any gaps that might indicate issues with completing transactions. Keep an eye out for passive churn, often caused by problems like expired cards or declined payments - this alone can account for nearly half of all churn.

Monitor Payment Speed and Success Rates

Speed and reliability are key to keeping customers happy. Measure API latency to ensure it stays below 500ms at the P99 level, which helps prevent lost transactions. Aim for an uptime of 99.9% over a 24-hour period to meet industry standards.

You should also track client (4xx) and server (5xx) error rates to quickly identify where issues are originating. Additionally, monitor approval rates to see how many payment requests successfully go through, and check settlement speed to understand how quickly funds are deposited into your account. These metrics will confirm whether the integration is delivering the efficiency improvements you aimed for.

Use Comet Cash Dashboards to Analyze Metrics

Comet Cash offers dashboards that bring all your performance data together in one place, giving you instant insights. These tools combine real-time monitoring with seamless integration, centralizing key metrics like payment performance, user behavior, and operational efficiency. Automatic alerts make it easy to spot sync errors or performance issues as they happen.

For instance, you can track payment processing velocity through the dashboard. A growing transaction volume - like a customer processing 10 invoices a month, then 15, then 20 - can signal business growth. Richard Dunbar, Senior Director of Partner Success at Stax, explains:

"If a customer is processing 10 invoices a month, and then they're doing 15, and then 20 - it's a good idea to reach out to that customer to have a health check. You can say something along the lines of, 'We noticed your business is growing. Anything we can do to help you?'"

This proactive approach not only creates opportunities for upselling but also strengthens customer relationships, ultimately increasing your Customer Lifetime Value (LTV).

Conclusion

Payment APIs play a crucial role in helping modern SaaS businesses grow. They streamline subscription invoicing, reduce payment failures, and efficiently manage high transaction volumes without requiring a complete overhaul of your payment systems. With the SaaS industry expected to hit $325 billion by 2028 and digital transactions growing at a 9% annual rate through 2026, having a reliable payment infrastructure isn’t just helpful - it’s essential for staying ahead of the competition.

Take Comet Cash, for example. This platform offers a non-custodial, real-time payment solution that supports Bitcoin and the Lightning Network, enabling instant cross-border payments. It also provides flexibility with stablecoins and tokenized assets. Unlike older systems, which can be up to 70% more expensive to operate, Comet Cash’s API-first approach grows with your business without adding unnecessary costs.

As your SaaS business expands, security and compliance become even more important. Navigating multi-currency transactions and meeting local regulations can be challenging, but with the right tools, it becomes a manageable task. This ensures your business remains competitive and resilient in today’s fast-paced digital landscape.

The numbers speak for themselves: one-third of businesses that adopted payment APIs reported a 10% boost in revenue. Faster payments, reduced transaction costs, and better customer retention all contribute to a stronger bottom line.

FAQs

How do payment APIs improve security for SaaS platforms?

Payment APIs enhance security for SaaS platforms through several advanced measures. One key feature is tokenization, which swaps sensitive payment details with secure, non-sensitive tokens, reducing the risk of data exposure. They also employ end-to-end encryption, ensuring that data remains protected during transmission and cannot be intercepted. On top of that, many APIs incorporate two-factor authentication (2FA), requiring an additional verification step to confirm user identities and prevent unauthorized access.

By leveraging these security measures, payment APIs help SaaS businesses protect customer data, strengthen user trust, and meet crucial industry standards like PCI DSS.

How does Comet Cash help reduce costs for international transactions?

Comet Cash cuts down the expenses tied to international transactions by doing away with steep currency conversion fees and trimming down transaction charges. With its integrated APIs, it supports a variety of currencies and payment methods, streamlining cross-border payments to make them quicker and more efficient. This approach doesn’t just boost profitability - it also elevates the customer experience, ensuring seamless transactions for your SaaS business.

How can integrating Comet Cash boost customer loyalty and drive revenue growth?

Integrating Comet Cash can play a key role in strengthening customer loyalty and driving revenue growth. By providing secure and hassle-free payment options, it makes transactions smoother and more convenient for your users. Its support for multiple payment methods and automated billing takes the complexity out of payments, leaving customers with a better overall experience.

When payment failures are minimized and processes are simplified, customers are more likely to return. This reliability fosters trust and encourages repeat business. The result? Happier customers, stronger retention rates, and a steady boost to your SaaS product's revenue.